After 36 yrs with State Farm I will be shopping my insurance needs next year. Your company is focused on selling services, but when needed, not there. We have 8 rentals and recently filed a claim involving waste dumping into the crawl space from a toilet & 2 kitchens. Only became aware of this when a tenant moved out after 9 yrs. We had black mold, Sheetrock and flooring issues to fix and compensation to a couple we had to move out in order to fix their bathroom. None of the tenants complained about anything and the only access to the crawl space is thru a trap door in each closet of the unit.

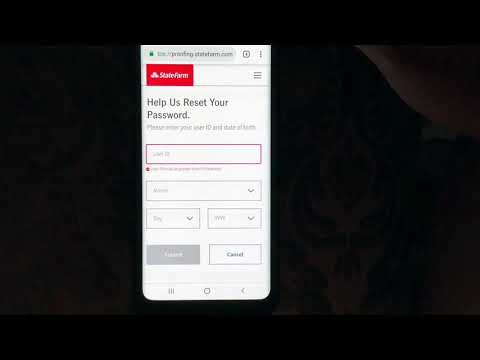

I have no idea how long this was happening and needed to get it fixed ASAP. After my agent transferred me over so I could file a claim, I answered her questions the best I could and she said a claim assoc would contact me in the next couple of days. 2 days later Keith Sullivan called and our conversation lasted long enough for him to tell me my policy didn't cover any of the damage. If you can't protect me from this type of situation, I'm not very comfortable thinking about the outcome of the next time I need you to step up to the plate.

I guess there is a good reason why they say you should always shop around when your policy comes up for renewal and do not feel this unwarranted loyalty to your current carrier. Oh by the way, this none covered event cost me $14,500. Many types of insurance policies renew on a regular basis, providing insurers the opportunity to increase rates, change provisions or drop clients.

Insurance companies often introduce new underwriting classes and plan rate schedules to offer new clients different premiums without changing current clients' rates. Some of these rate changes could offer you lower premium payments, but you have to apply for a new policy to get it. Many insurance companies pay a commission to the agent who wrote the initial policy, so many servicing agents will see if product changes could save new clients money on their existing coverage. Saving a client money on existing coverage is an easy way for an agent to write a new policy. State Farm has violated multiple state laws governing insurance practices by insurance companies.

First of all, as of the date of their response I had not received my specific homeowners insurance policy despite requesting that on 3 occasions, including twice nearly two years ago. I insist that they get fined to the fullest extent of the law once you determine, as I am very confident you will, that they violated multiple laws. I've been their customer for over 20 years and am so disturbed by their continued unethical and incompetent handling of my claim, that I plan to switch providers in the next few months. Allstate and State Farm both have good customer service options. However, support for certain policies, like life insurance and business insurance, is only available via phone or in person.

State Farm was founded in June 1922 by retired farmer George J. Mecherle as a mutual automobile insurance company owned by its policyholders. The firm specialized in auto insurance for farmers and later expanded services into other types of insurance, such as homeowners and life insurance, and then to banking and financial services. Since auto insurance quotes are so personalized, it's a good idea to compare several quotes. If you're affiliated with the military or are part of a military family, USAA is a great option.

The company has high auto insurance industry ratings and often provides the cheapest car insurance rates for many drivers. Founded in 1922, State Farm now has approximately 58,000 employees and nearly 19,000 contractor agents servicing 83 million policies and accounts across the United States. It offers more than 100 products, including auto, home, and life insurance, as well as banking, mutual funds, and commercial products. State Farm's phone-based agents are not in the position to negotiate your rates or to make decisions about claims.

If you are concerned or upset about your rates or the status of a claim, keep in mind that a customer service representative cannot resolve such concerns to your satisfaction. Instead, you may want to file a request or appeal with the company so that somebody with authority can address your concerns. You may also wish to speak with your insurance agent who may likewise be in a better position to provide a real resolution.

Most drivers cancel or switch insurance because of premium costs. If you had issues with billing as a State farm customer, you're not alone. Customer reviews of State Farm with complaints mention issues with claims, unwanted marketing and overcharges. In fact, the company wrongly charged customers on premiums and issues refunds totaling over $13 million in 2017. State Farm offers several car insurance discounts, including the Steer Clear Program for safe drivers under age 25. Young drivers typically pay high insurance rates, but the Steer Clear Program provides savings for younger drivers with no at-fault accidents or moving violations in the past three years.

To review State Farm and Allstate, we started by looking at their areas of availability, the NAIC Complaint Index score, and the AM Best score for each provider. The NAIC Company Complaint Index is a ratio of complaints per market share with 1.0 being the average and anything above 1.0 considered to have more complaints than expected for its size. Then, we looked at the coverage options, discounts, and riders available for auto, home, renters, and commercial insurance.

Finally, we did some research into customer reviews and testimonials and evaluated the ease of getting a quote and filing a claim. The study measured claims satisfaction in several categories, including estimation process, repair process, rental experience and settlement. State Farm is also well-regarded for its local agents and the satisfactory customer service they provide.

The company has more local agents than any other auto insurance provider. The bank opened in May 1999 and is operated by State Farm Financial Services, FSB, a subsidiary of State Farm Mutual Automobile Insurance Co. Home mortgages are available countrywide over the phone or through agents.

The company offers options to bundle insurance to get a better rate. Beyond vehicle insurance, State Farm provides homeowners insurance, life insurance, health insurance, business insurance, and other categories. Using one company for multiple policies is a great way to lower your car insurance costs.

Attempt to negotiate a fair settlement offer – Fortunately, the vast majority of personal injury cases settle out of court. Reaching a fair settlement agreement takes both significant negotiation skills and an understanding of the law. Parties who are unfamiliar with the process are putting themselves at a distinct disadvantage if they choose to represent themselves in settlement negotiations. Luckily, the legal team of Stewart J. Guss, Injury Accident Lawyers, consists of skilled negotiators who know how to get insurance companies like State Farm to pay up. Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies.

We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list. Some Business Owners policies are underwritten by Progressive. These guidelines will determine the company quoted, which may vary by state.

The company quoted may not be the one with the lowest-priced policy available for the applicant. Certain Progressive companies may be compensated as licensed agencies for performing services on behalf of the Business Owners, General Liability, Professional Liability and Workers' Compensation insurers. Progressive assumes no responsibility for the content or operation of the insurers' websites.

Prices, coverages, privacy policies and compensation rates may vary among the insurers. Highly disappointed I thought this company was reputable turns out your only paying because the name. They wanted 100$ for liability on my car 88$ for my truck combining them roughly 170 something. I called to have tech support on my app also to get a quote on a vehicle they never returned my call I was supposed to meet with an agent to go over policy's and she never showed up. I switched company's who congratulated me for my perfect driving record and now I'm pay 96$ for both vehicles. Over the course of the past 90 years, State Farm has been the auto insurance customers have grown to trust due to the commitment to the customer and overall customer experience.

The company is based in the United States, with a reach exceeding 81 million customers across the nation as well as Canada. Customer service is critical to success in order for State Farm to remain viable in the insurance business. This is why the service department offers unparalleled customer service relating to policies and customer concerns. Among the largest car insurance companies, State Farm is the cheapest for most people. On average, its liability-only policies cost $597 per year, and its full-coverage plans are $1,589.

State Farm offered the cheapest coverage in 10 states, the most states behind USAA. If you've ever shopped for insurance, you're probably familiar with State Farm and Allstate. They're two of the largest car insurance companies on the market, and each insures millions of people around the country. State Farm and Allstate are well known for their car insurance offerings, but you can also get a variety of other policies, like home, renters, business, pet, and life insurance. After comparing State Farm vs. Geico, we think both providers are reputable choices for coverage.

We named Geico our Editor's Choice for its strong industry reputation, affordability and range of coverage options. We named State Farm the Most Popular Provider for its market share and perks like programs for young drivers. However, Geico's better customer experience ratings and widely applicable discounts can be a deciding factor for some drivers.

Both companies also have highly rated mobile apps, which policyholders can use to view their insurance ID cards, file claims, pay bills and change policy information. Because of the complexity of the products, most states prohibit insurance companies from negotiating rates on a customer-by-customer basis. Rates are set based on classes of underwriting risk, so two agents at the same company quoting rates for the same policy at the same time will wind up with the same premium.

While this helps protect less-knowledgeable customers, it also prevents customers from getting agents to compete with each other on price. According to The Zebra, the average State Farm insurance policy costs $108 per month. However, you might get a different quote based on your age, gender, and the state where you live. Other factors, including your driving record, will also affect rates.

It's best to call around and obtain several car insurance quotes before deciding which insurer is best for you. Using car insurance rates from across the country, ValuePenguin compared the cost of coverage from State Farm, Allstate, Geico, Progressive and Farmers. We gathered quotes for a 30-year-old male driver with no history of accidents and average credit, unless otherwise noted. Farmers Insurance gives its policyholders the most discount opportunities.

Many are easy for most people to achieve, such as savings for signing up for coverage online or electing to receive bills electronically and pay automatically. However, due to Farmers' high cost of coverage, Geico — the far cheaper provider with the second-most discount opportunities — gives drivers the greatest potential for savings. Shoppers who want to buy auto insurance from the company with the best reputation for customer service should consider Allstate. The insurer receives fewer complaints about its claims service relative to its market share than its competitors, according to data from the National Association of Insurance Commissioners . Apart from offering P&C insurance, State Farm subsidiaries and affiliates provide life and health insurance, annuities, mutual funds and banking products.

In 2020, the firm was ranked 36th on the Fortune 500 list of largest companies. It has approximately 58,000 employees and sells its products through a 19,000-strong force of independent contractor exclusive State Farm agents. Commercial insurance policies are based on factors unique to your business, including the number of employees you have, the risk your employees face, and where your business operates. Based on our research, Allstate and State Farm don't offer any discounts for commercial insurance. However, you might qualify for a multi-policy discount if you purchase two or more business insurance policies from the same company.

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. After Jerry helps you switch to another provider and cancel your old car insurance, the app will keep monitoring insurance rates for you on renewal.

This ensures you're always getting the coverage you want at the best price. Some insurance can travel with you easily, but other types don't. You'll obviously need to change your homeowner's or renter's policy if you move. Car insurance can travel with you, but you'll need to change it if you move to a state where your current carrier isn't licensed. Even if the company is licensed in your new state, some of your policy terms and rates may change according to state laws and rates in your area.

Other policies, such as a life insurance plan you purchased outside of work, can usually travel with you without any issues. As you're planning your move, call your agent to discuss your options. There's no specific rule for how often you should or shouldn't change insurance companies, but it's a good idea to shop policies and rates every year around your renewal time. Even if you don't switch, you may be able to use new policy quotes as leverage for renegotiating rates with your current agent. State Farm is one of the best car insurance companies for drivers with at-fault accidents on their driving record.

According to The Zebra, the average monthly premium is $135 after such an accident. ValuePenguin commissioned a survey and asked current policyholders about their satisfaction with claims and the customer service of their insurer. In our table, the Claim Satisfaction Rating represents the percentage of respondents who were extremely satisfied with their most recent claim experience. The Customer Service Rating represents the percentage of respondents who rated the customer service of their insurance company as "excellent." Progressive tends to have cheaper car insurance than Allstate for many different types of drivers.

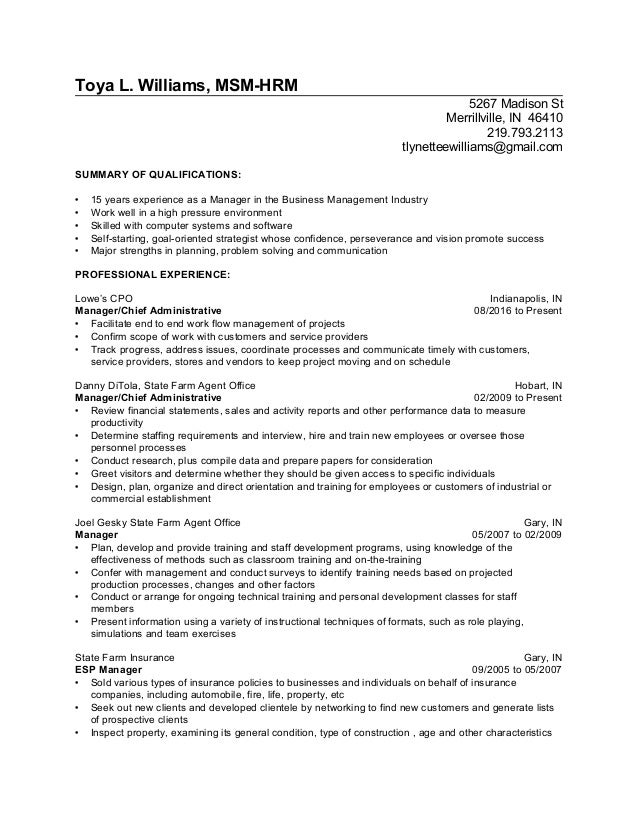

State Farm Agent Phone Number However, drivers with poor credit and young drivers might consider either insurer. Drivers with poor credit were quoted rates by Allstate that were only 19% higher than those from Progressive, while the cost of car insurance for young drivers is only 9% more expensive at Allstate. But after being at this job for a little over 1.5 years I realized I didn't like it. I helped people file claims, called if their payment was late, and other policy maintenance jobs.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.